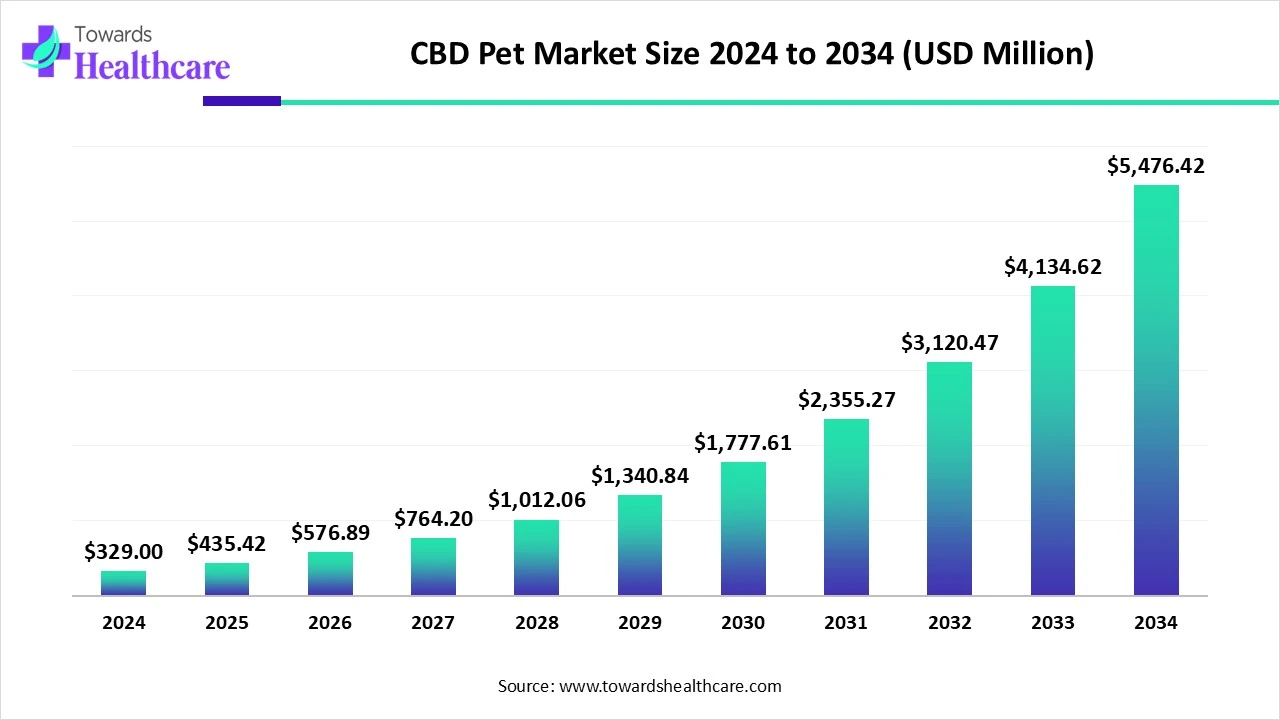

CBD Pet Market Projected Increase from USD 329 Million in 2024 to USD 5476.42 Million by 2034

The global CBD pet market size was valued at USD 435.42 million in 2025 and is predicted to hit around USD 5476.42 million by 2034, rising at a 32.5% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

Ottawa, Feb. 06, 2026 (GLOBE NEWSWIRE) -- The global CBD pet market size is calculated at USD 576.89 million in 2026 and is expected to reach around USD 5476.42 million by 2034, growing at a CAGR of 32.5% for the forecasted period.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/5621

Key Takeaways

- Valuation of the CBD pet market is projected to hit USD 329 million by 2024.

- By 2034, will likely exceed USD 5476.42 million.

- Estimated to grow at a CAGR of 32.5% starting in 2025.

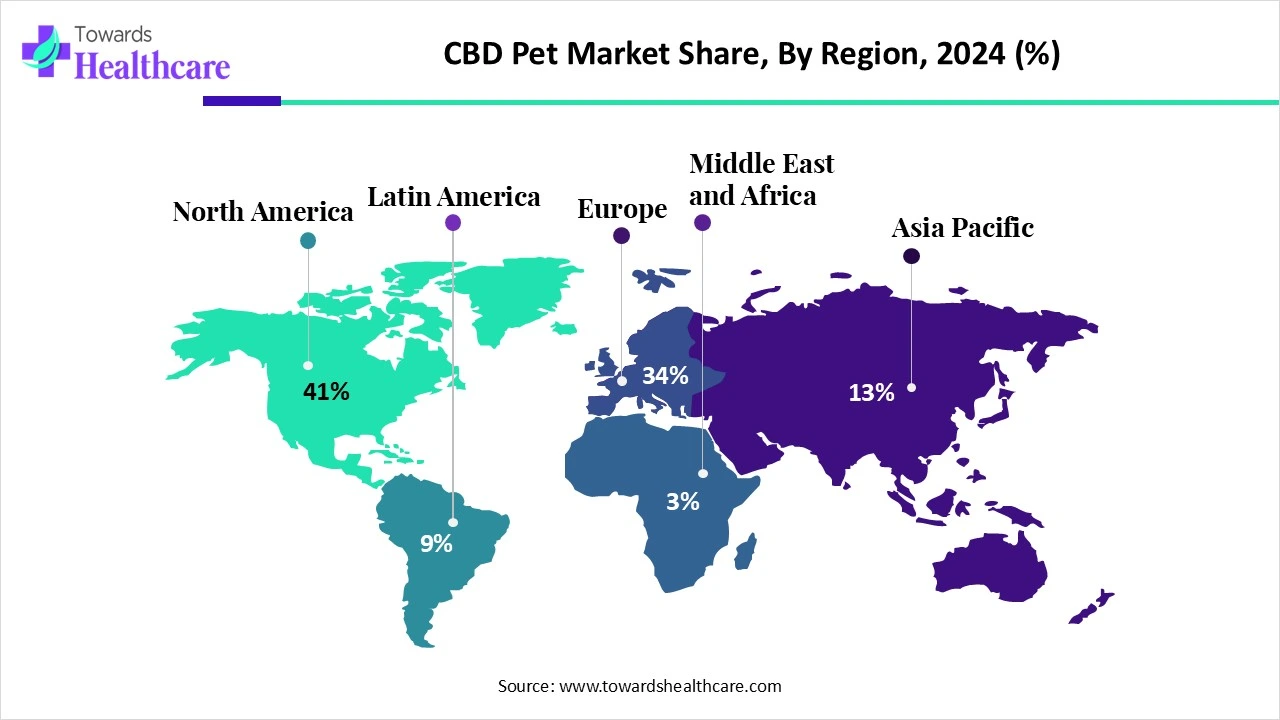

- North America was dominant in the market in 2024.

- Asia-Pacific is expected be the fastest-growing region during 2025-2034.

- By animal type, the dogs segment dominated the market in 2024.

- By animal type, the cats segment is expected to grow rapidly in the coming years.

- By distribution, the e-commerce segment captured a major share of the market in 2024.

- By distribution, the pet specialty stores segment is expected to witness notable expansion during the forecast period.

- By indication, the joint pain segment led the market in 2024.

- By indication, the anxiety/stress segment is expected to register the fastest growth during 2025-2034.

What are Immersive Growth Factors for CBD Pet?

Inclusion of the sale of cannabis-derived, hemp-based products, especially oils, treats, and topicals to treat health conditions in animals, such as pain, anxiety, and inflammation, is referred to CBD pet market. The overall market progression is fueled by the increasing demand for natural, non-psychoactive remedies for pet anxiety & pain, widening pet humanization, and rising regulatory acceptance. Eventually, the FDA’s Center for Veterinary Medicine (CVM) published warning letters to various brands for marketing unapproved CBD products, addressing the industry's requirement for better compliance & evidence-based formulations.

What are the Prominent Drivers in the CBD Pet Market?

One of the significant catalysts, a rise in the number of cases of arthritis, anxiety, and skin concerns in pets are driving demand for natural, holistic, & non-intoxicating, plant-based remedies. Alongside, suitable regulatory developments for hemp-derived CBD and bolstered R&D into product effectiveness are encouraging the market growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What are the Key Trends in the CBD Pet Market?

- The vital firms are stepping into the development of soft chews for their ease of administration, & also functional treats joint pain and anxiety.

- Researchers are studying the long-term, daily administration of CBD to track potential side effects, like increased liver enzymes & to find safe, sustainable, and effective doses.

What is the Significant Limitation in the CBD Pet Market?

A very specific limitation is that restricted legal guidelines from bodies, such as the FDA or similar agencies in the UK/EU leaves products in a grey area, often marketed as supplements instead of medicines. Also, in some cases, the market faces issues in the purity, potency, and quality of products, which require readily available certificates of analysis (COA) to ensure safety.

Regional Analysis

How did North America Hold a Major Share of the Market in 2024?

Exploration of greater R&D investments to promote product innovation and accelerating disposable income, fueled the North America market’s dominance. As well as, the region is bolstering online platforms & specialized pet retail channels to make these products broadly available, with extended accessibility. Currently, Health Canada is extensively executing a novel regulatory workflow for non-prescription, CBD-based veterinary products. Also, the FDA requested public comments to fill data gaps on the safety, efficacy, & dosage of CBD in animals.

How did the Asia Pacific Expanded Notably in the CBD Pet Market in 2024?

Asia Pacific is estimated to witness rapid expansion, as the region is experiencing greater media attention & online information regarding the benefits of hemp-derived CBD for pets, which is accelerating consumer demand. Exceptional urbanization and booming wealth in China, India, and South Korea are enabling pet owners to contribute more to more on specialized, high-quality pet care. India’s key leaders, such as Awshad has strengthened its product line, emphasizing CBD-infused pet treats & drops to lower stress and anxiety in dogs. Whereas, Cure by Design & ItsHemp platforms are used for purchasing safe, third-party lab-tested CBD oils for pets.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Segmental Insights

By animal type analysis

Which Animal Type Dominated the CBD Pet Market in 2024?

The dogs segment held the largest revenue share of the market in 2024. CBD has a major role in chronic pain, like arthritis, anxiety, inflammation, epilepsy, and cognitive conditions, especially in geriatric dogs. The latest research explored in Frontiers in Veterinary Science has demonstrated that dogs administered CBD products for several years showed less intense aggression over time, which suggest to treat behavioral concerns.

However, the cats segment is predicted to expand fastest. The globe is moving from purely anecdotal reports to scientific, peer-reviewed studies, which emphasizes long-term safety, accurate dosing, & particular therapeutic applications, especially pain management, anxiety reduction, and sedation in cats. A recent study of "undesirable urination" in cats showed that 4.0 mg/kg of daily CBD crucially lowered these behaviors as compared to a placebo.

By distribution analysis

How did the E-commerce Segment Lead the Market in 2024?

In 2024, the e-commerce segment registered dominance with a dominant share of the CBD pet market. This distribution extensively provides the convenience of doorstep delivery, a diverse product variety, & access to third-party lab reports. Recently, Amazon and Chewy have upgraded their policies to enable more hemp-derived CBD listings, which ultimately raises brand reach.

In the future, the pet specialty stores segment will expand notably. Global expansion of pet humanization and therapeutic awareness is mainly supporting the progression of these stores. In this era, Pet Releaf is one of the first suppliers to explore USDA-certified organic hemp across its comprehensive supply chain. Alongside, Kradle bolstered into cats' wellness with salmon-flavored lickable CBD supplements & accelerated its nationwide retail presence.

By indication analysis

Why did the Joint Pain Segment Dominate the CBD Pet Market in 2024?

The joint pain segment was dominant with the biggest share of the market in 2024. Primarily, ageing dogs and cats are facing arthritis, hip dysplasia, and general joint pain issues, which demand CBD. The latest study has shown an assessment of a combined CBD (15%), cannabigerol (CBG, 15%), & other natural ingredients on dogs with severe arthritis. Another study revealed a 20:1 CBD: THC cannabis herbal extract on dogs with cruciate ligament surgery (TPLO).

Moreover, the anxiety/stress segment is anticipated to expand rapidly. The world is looking for non-psychoactive, natural solutions to skip the side effects of traditional medications in the growing issues, such as excessive barking, travel anxiety, and noise phobias. An extensive development includes CV Sciences, which unveiled NASC-certified +PlusCBD Pet Calming Care Chews & Hip and Joint Health Chews.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

What are the Substantial Developments in the CBD Pet Market?

- In February 2025, Kradle widened its product portfolio by unveiling its first-ever line of cat wellness products, available in both CBD and non-CBD formulations.

- In January 2025, ElleVet Sciences introduced its novel Feline CBD + CBDA Soft Chews to support stress relief, mobility and overall well-being in cats.

CBD Pet Market Key Players List

- Honest Paws LLC

- Canna-Pet LLC

- Laboratoire Francodex

- Pet Releaf

- HolistaPet

- Joy Organics

- Wet Noses Natural Dog Treat Co.

- CBD Living

- PETstock

- Garmon Corp.

- Charlotte’s Web, Inc.

- Green Roads

- HempMy Pet

- FOMO Bones

Browse More Insights of Towards Healthcare:

The global companion animal health market size is calculated at US$ 25.28 in 2024, grew to US$ 27.64 billion in 2025, and is projected to reach around US$ 61.74 billion by 2034. The market is expanding at a CAGR of 9.34% between 2025 and 2034.

The global monoclonal antibodies in veterinary health market size is calculated at US$ 1.23 in 2024, grew to US$ 1.45 billion in 2025, and is projected to reach around US$ 6 billion by 2034. The market is expanding at a CAGR of 17.13% between 2025 and 2034.

The global pet at-home diagnostic tests market size was estimated at USD 84.83 million in 2025 and is predicted to increase from USD 89.79 million in 2026 to approximately USD 149.78 million by 2035, expanding at a CAGR of 5.85% from 2026 to 2035.

The global veterinarian care market size began at US$ 21.87 billion in 2024 and is forecast to rise to US$ 23.14 billion by 2025. By the end of 2034, it is expected to surpass US$ 38.3 billion, growing steadily at a CAGR of 5.75%.

The global veterinary CRO and CDMO market size is calculated at USD 7.17 billion in 2024, grows to USD 7.77 billion in 2025, and is projected to reach around USD 16.13 billion by 2034.The market is expanding at a CAGR of 8.43% between 2025 and 2034.

The global companion animal health market size is calculated at US$ 25.28 in 2024, grew to US$ 27.64 billion in 2025, and is projected to reach around US$ 61.74 billion by 2034. The market is expanding at a CAGR of 9.34% between 2025 and 2034.

The global vet ultrasound system market was estimated at US$ 400 million in 2023 and is projected to grow to US$ 845.41 million by 2034, rising at a compound annual growth rate (CAGR) of 7.04% from 2024 to 2034.

The global animal biotechnology market size is calculated at US$ 30.97 billion in 2025, grew to US$ 34.05 billion in 2026, and is projected to reach around US$ 79.82 billion by 2035. The market is expanding at a CAGR of 9.93% between 2026 and 2035.

The global animal drug compounding market size was estimated at USD 1.68 billion in 2025 and is predicted to increase from USD 1.82 billion in 2026 to approximately USD 3.73 billion by 2035, expanding at a CAGR of 8.32% from 2026 to 2035.

The global animal genetics market size is calculated at USD 6.51 billion in 2024, grew to USD 6.93 billion in 2025, and is projected to reach around USD 12.11 billion by 2034. The market is expanding at a CAGR of 6.4% between 2025 and 2034.

The global animal model market size is calculated at USD 2.54 billion in 2024, grew to USD 2.76 billion in 2025, and is projected to reach around USD 5.81 billion by 2034. The market is expanding at a CAGR of 8.64% between 2025 and 2034.

The global animal vaccine market size is anticipated to grow from USD 18.98 billion in 2025 to USD 44.77 billion by 2034, with a compound annual growth rate (CAGR) of 10% during the forecast period from 2025 to 2034, as a result of a rising focus on food safety and security.

Segments Covered in the Report

By Animal Type

- Dogs

- Foods/Treats

- Vitamins & supplements

- Cats

- Foods/Treats

- Vitamins & supplements

- Others

By Indication

- Joint Pain

- Anxiety/Stress

- Epilepsy

- General Health/Wellness

- Other Indications

By Distribution

- Pet Specialty Stores

- E-commerce

- CBD Store

- Others

By Regions

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway

- Asia Pacific

- Japan

- China

- India

- South Korea

- Australia

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/5621

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Towards Packaging | Towards Food and Beverages | Towards Chemical and Materials | Towards Dental | Towards EV Solutions | Healthcare Webwire

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Also Read:

https://www.towardshealthcare.com/insights/mental-health-ehr-software-market-sizing

https://www.towardshealthcare.com/insights/digital-therapeutics-for-mental-health-market-sizing

https://www.towardshealthcare.com/insights/behavioural-mental-health-tools-market-sizing

https://www.towardshealthcare.com/insights/mental-health-supplement-for-women-market-sizing

https://www.towardshealthcare.com/insights/mental-health-practice-management-software-market-sizing

https://www.towardshealthcare.com/insights/us-cell-and-gene-therapy-cdmo-market-sizing

https://www.towardshealthcare.com/insights/oral-solid-dosage-contract-manufacturing-market-sizing

https://www.towardshealthcare.com/insights/us-cell-and-gene-therapy-clinical-trials-market-sizing

https://www.towardshealthcare.com/insights/drug-delivery-devices-market-sizing

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.